Oklahoma Equal Opportunity Education Scholarship Act

Expanded in 2021, The Oklahoma Equal Opportunity Education Scholarship Act gives Oklahoma taxpayers a powerful way to invest directly in public education. By contributing to approved public school foundations like the Oklahoma City Public Schools Foundation, donors can redirect a portion of their state tax liability and receive valuable income tax credits in return. It’s an opportunity to make a high-impact gift that fuels innovative programs for OKCPS students while maximizing your own tax benefits.

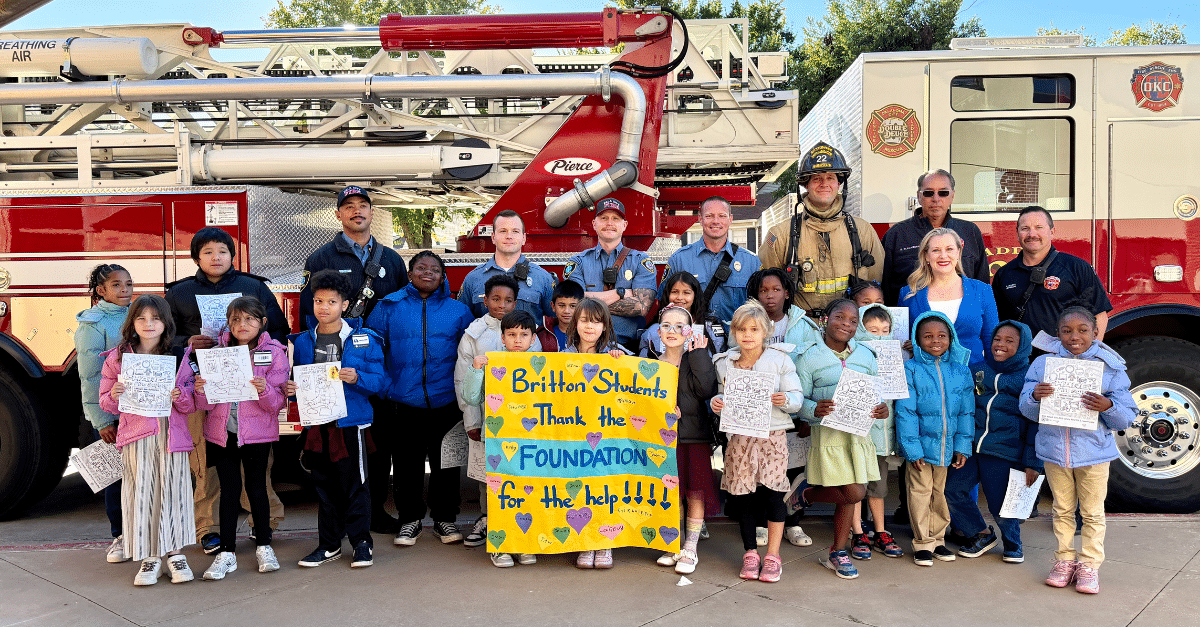

The donor’s non-refundable contribution will be used to support educational services for Oklahoma City Public Schools students, specifically DonorsChoose project support, ReadOKC activities and Teacher Pipeline Program support.

How it works

- Fill out our form below. We welcome one-year pledges, however, in order to maximize your state tax credit, please read through the benefits of a one-year pledge vs. two-year.

- Select Your Contribution Level. Because of the rigorous reporting requirements, the following minimum contribution levels have been set:

- Individuals/Couple $1000

- Businesses $2,500

- Commit To Two Years. The most effective way to maximize your state tax credit is to commit in writing to a two-year pledge. By filling out our form, you’re committing to a one- or two-year pledge.

The Breakdown

| Donation | One Year (50%) | Two Year (75%) |

| $2,500 | $500 | $750 |

| $5,000 | $1,000 | $1,500 |

| $10,000 | $5,000 | $7,500 |

PLEASE CONSULT YOUR PROFESSIONAL TAX ADVISOR FOR SPECIFIC TAX ADVICE.